Executive Summary

A summary of the key takeaways and recommendations – your company’s current value, risk profile, industry multiples, and recommendations for improving saleability and sale price.

Valuation is a key step in selling and buying a business: Most frequently asked question from business owners who are ready to sell is “How much is my business worth”, “What is the value of my business”? Determining the value of a business takes knowledge, experience, understanding market conditions and is often a complex process. Business brokers like us provide a “Broker Opinion of Value” for a business based on current market conditions also known as Market Approach. This is the most commonly used method among various other methods of valuation.

The underlying principle of market approach is: A buyer will pay no more than which he/she would have to pay to purchase an equally desired substitute in the current market conditions. There are different kinds of buyers in the market looking for businesses with different goals and each buyer may have a different approach to the valuation, so it is crucial to price the business accordingly. Pricing the business higher than the market value will not generate interest and pricing it too low is leaving money on the table.

The type of valuation we offer is “Broker Opinion of Value” and this kind of value proposition is backed up by factors such as comparative market analysis of similar sold and unsold business, type of business, business trends, seller financials such as earnings (financial performance), buyer return of investment and many other factors commonly referred as “Direct Market Data Method”. The goal of direct market data method is to find the most probable selling price of a small business in the current market. If you want to know what your business can sell for, you would start looking at comparable business that have sold. This is a simple concept; the devil is in the details. As we always say there may be many approaches to the value but there is only one market.

We have access to several recognized business databases with both historical/current data for sold and unsold businesses. This data helps us in understanding business trends and the value for which they are selling. There is much to a broker opinion of value than just the data available. As a matter fact analyzing comparable data is a last step in valuation there are many steps before reaching to this point like finding and calculating the annual discretionary earning, current assets, fair market value of assets and many more.

Finally, we prepare a “Business Evaluation Report”. The Basic report provide an understanding of the business value which helps in deciding to sell a business. Detailed report can also be provided for a charge.

The broker opinion of value should not be construed to be compliant with Uniform Standards of Professional Appraisal Practice (USPAP), and it would not be useful for any purpose other than estimating the current market price of the stated specific assets of the subject business. Certified business evaluations are different from broker opinion of value. Certified business evaluations are done by certified appraisers and in some cases, we recommend independent third-party valuation services. If you need a certified business evaluation, ask one of our advisors for a recommendation.

Discovery Call

Free

Valuation – Value Acceleration Calculator ™

Free

Valuation – Market Value Assessment ™ – Lite

$5,750

Valuation – Market Value Assessment ™ – Standard

$9,750

Valuation – Market Value Assessment ™ – Premium

$15,750

Discovery Call

Free

Strategy Session

Free

Sell-Side Advisory – Consulting Fee (refunded from Success Fee)

$2,500 – $5,000/mo

Sell-Side Advisory – Success Fee *

2.5% – 6.5%

Discovery Call

Free

Deal Origination – Private Equity **

Free Search

Buy-Side Advisory – Consulting Fee (refunded from Success Fee)

$2,500 – $5,000/mo

Buy-Side Advisory – Success Fee

3.5% – 6.5%

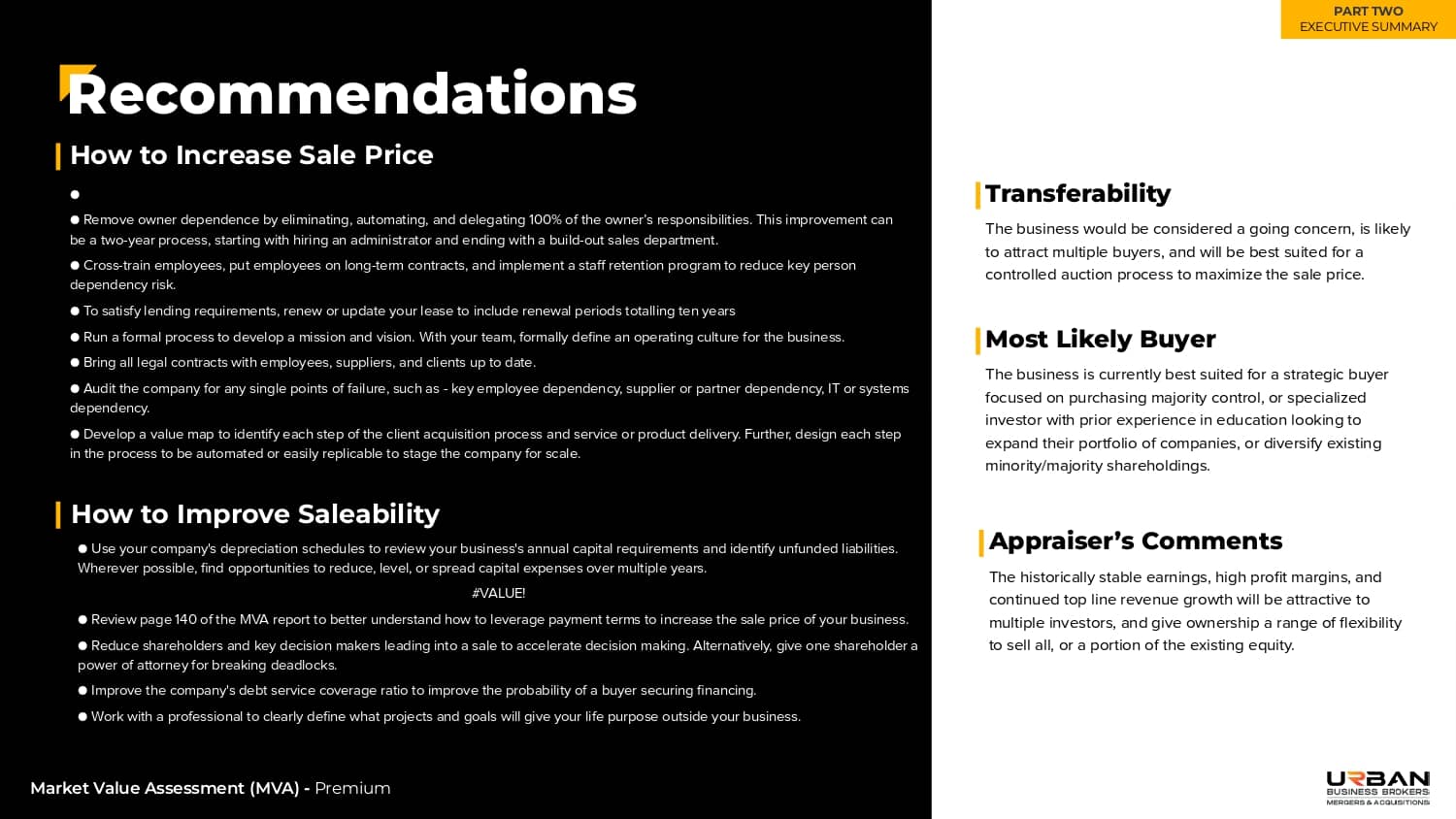

A step-by-step guide for increasing company value, specific to your business.

A summary of the key takeaways and recommendations – your company’s current value, risk profile, industry multiples, and recommendations for improving saleability and sale price.

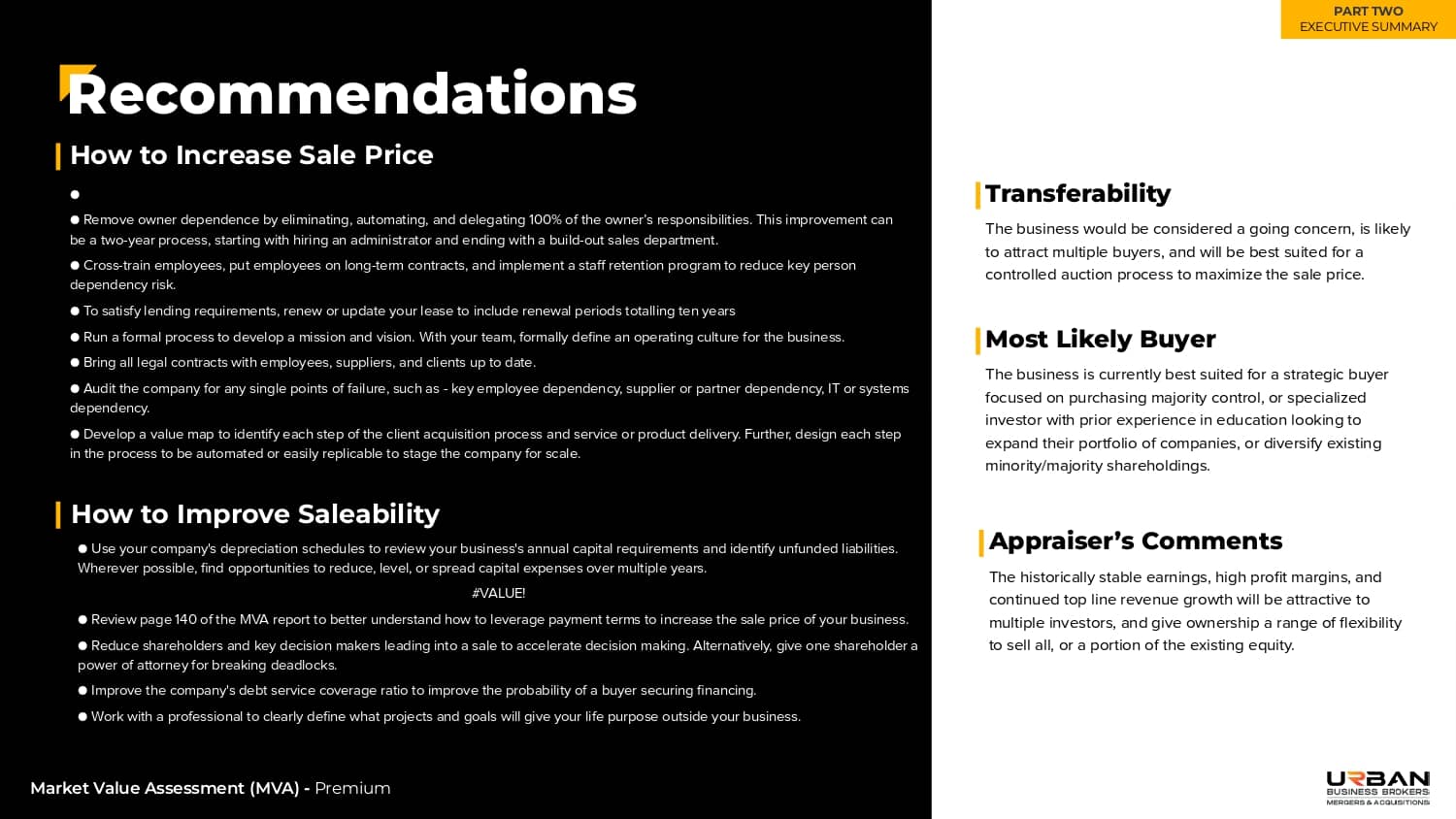

Our analysts normalize (adjust) your reported financials based on certain parameters to identify the true earning potential of your firm.

This normalization process creates a set of adjusted financials, which may be requested by potential buyers.

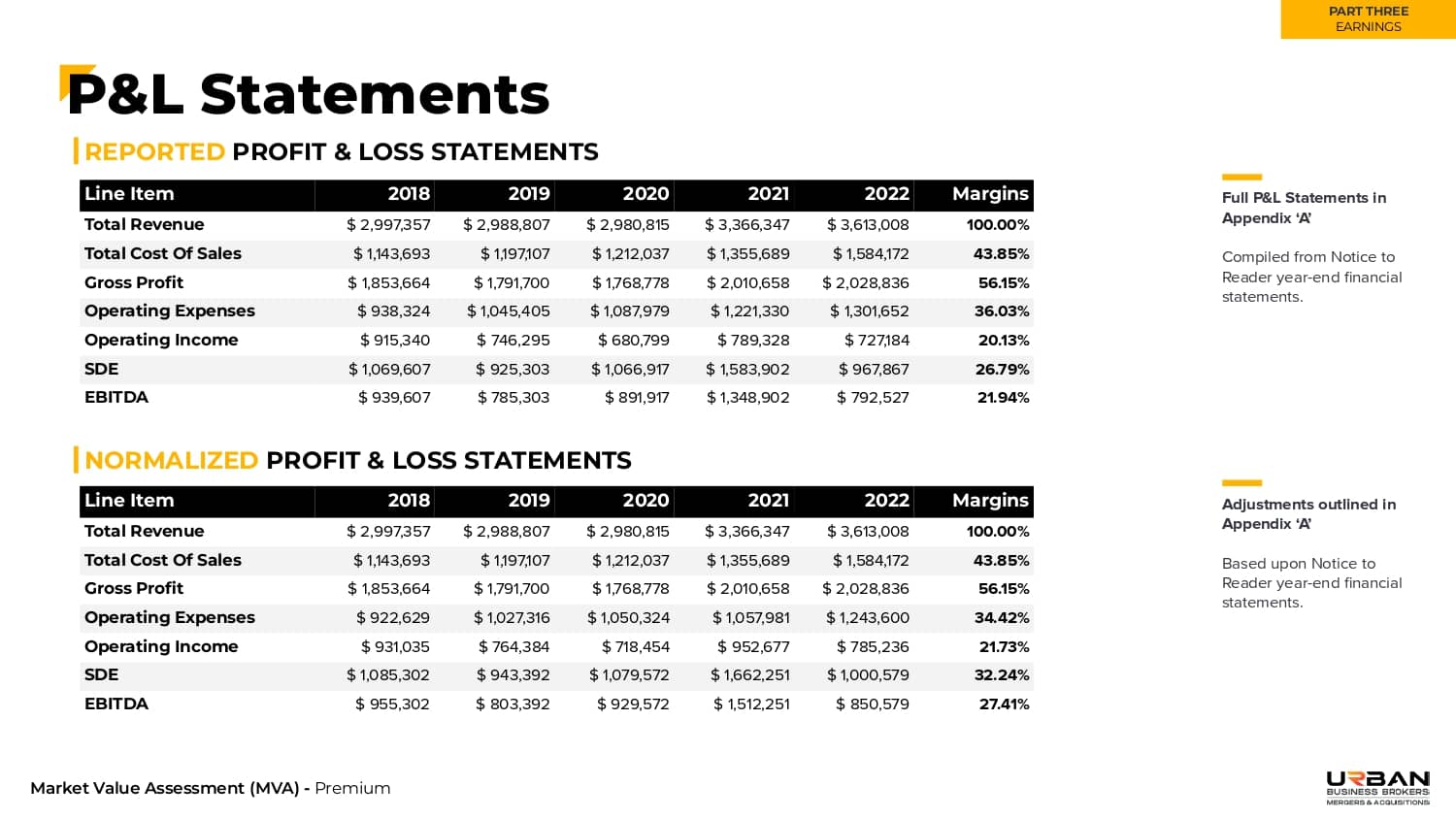

The primary reason a company will fail to sell is that returns do not offset the risk associated with them.

Where risk is identified, it is likely easier to reduce risk than increase returns.

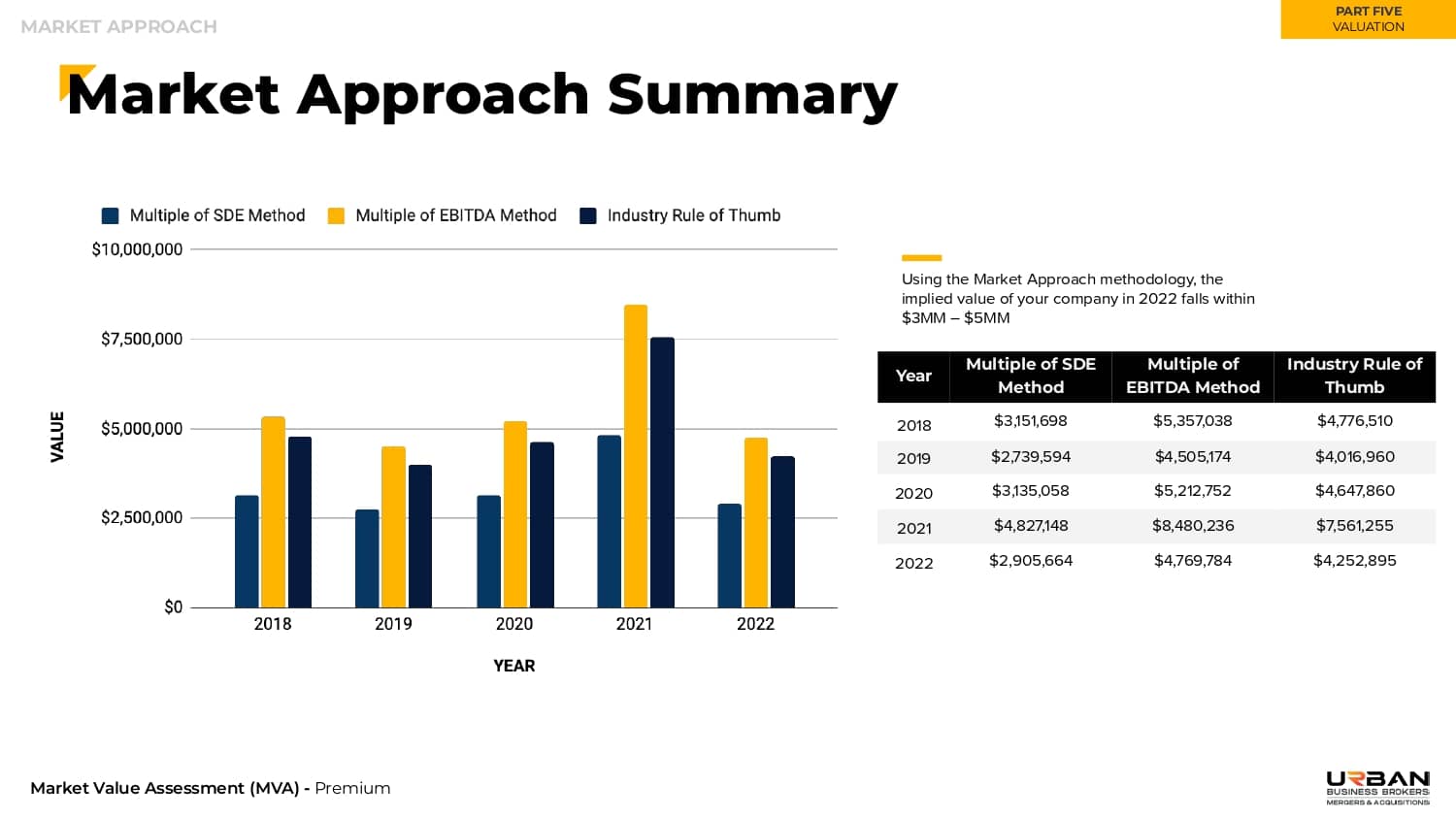

This section of the report compares eleven different valuation methodologies to determine a market value of your company.

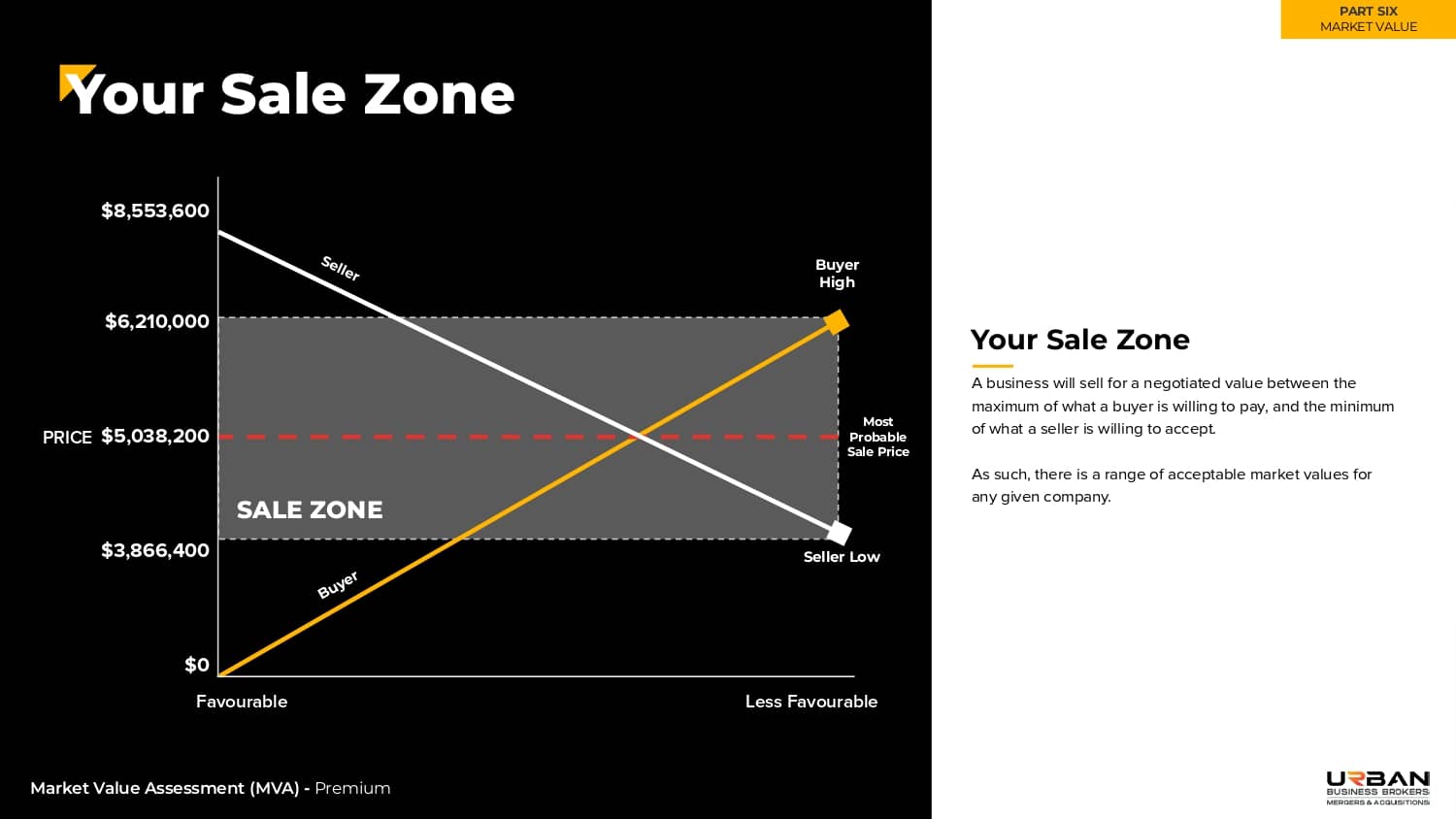

This section outlines the exact range of values that buyers will be willing to pay for your business.

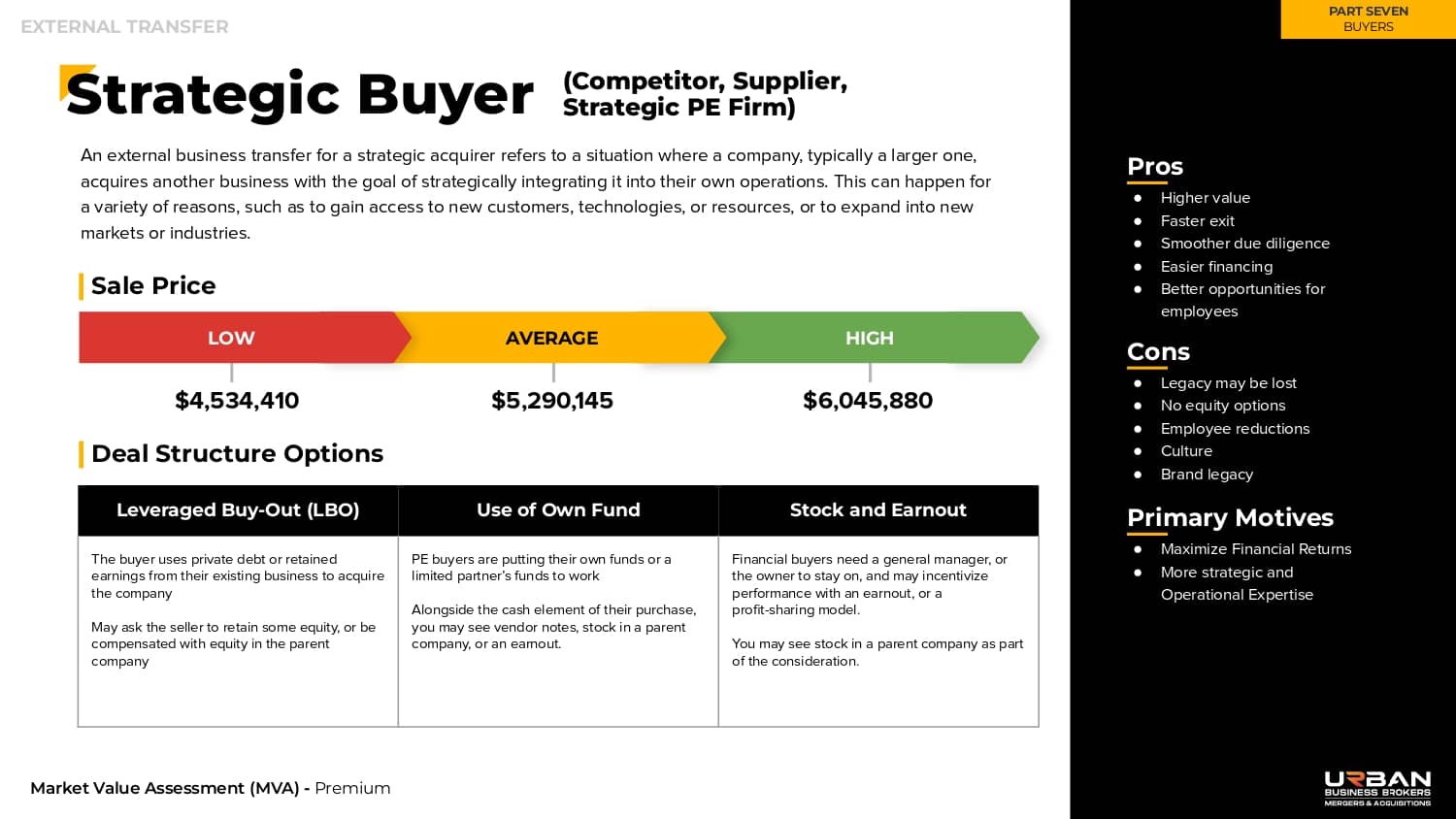

Not all buyers are created equally.

This section outlines twelve different types of buyers in the market, the pros and cons of each, how much they are likely to pay, and how they typically structure a purchase.

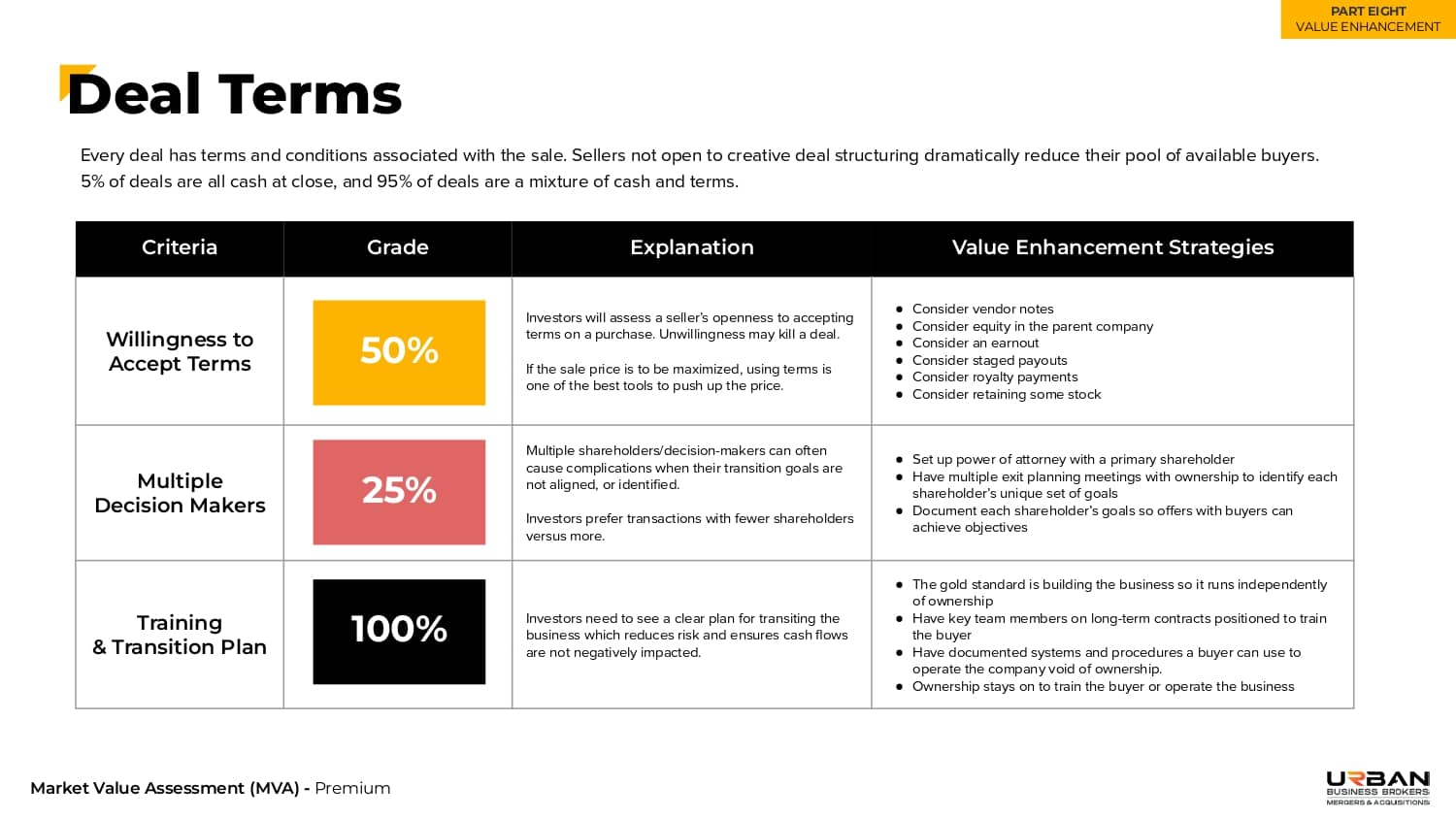

This section outlines clear steps to reduce risk in various areas, with the objective of increasing value.

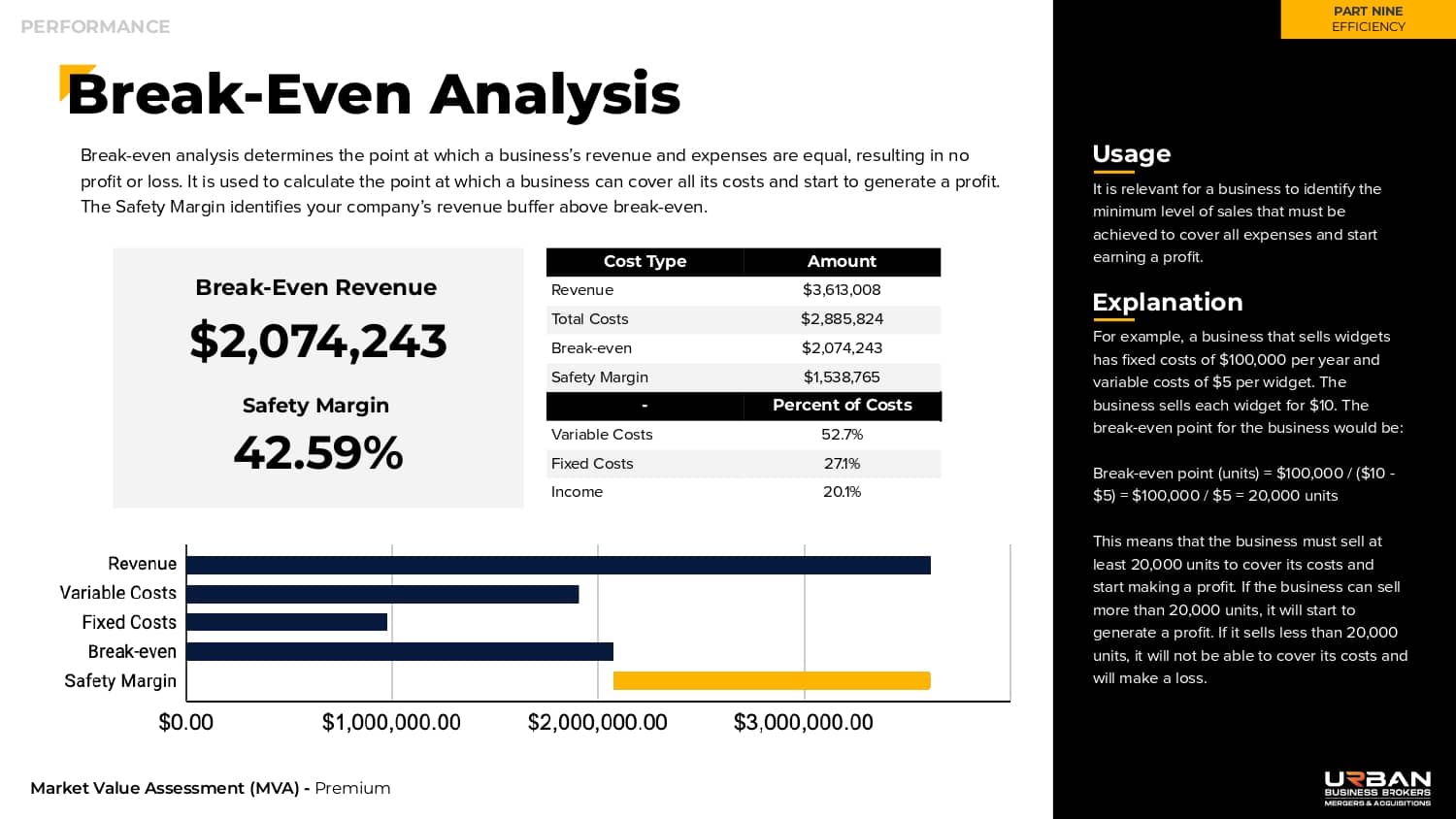

This section includes a benchmark analysis, break-even analysis, and sustainable growth analysis

Twenty industry ratios are utilized to grade your company based on efficiency.

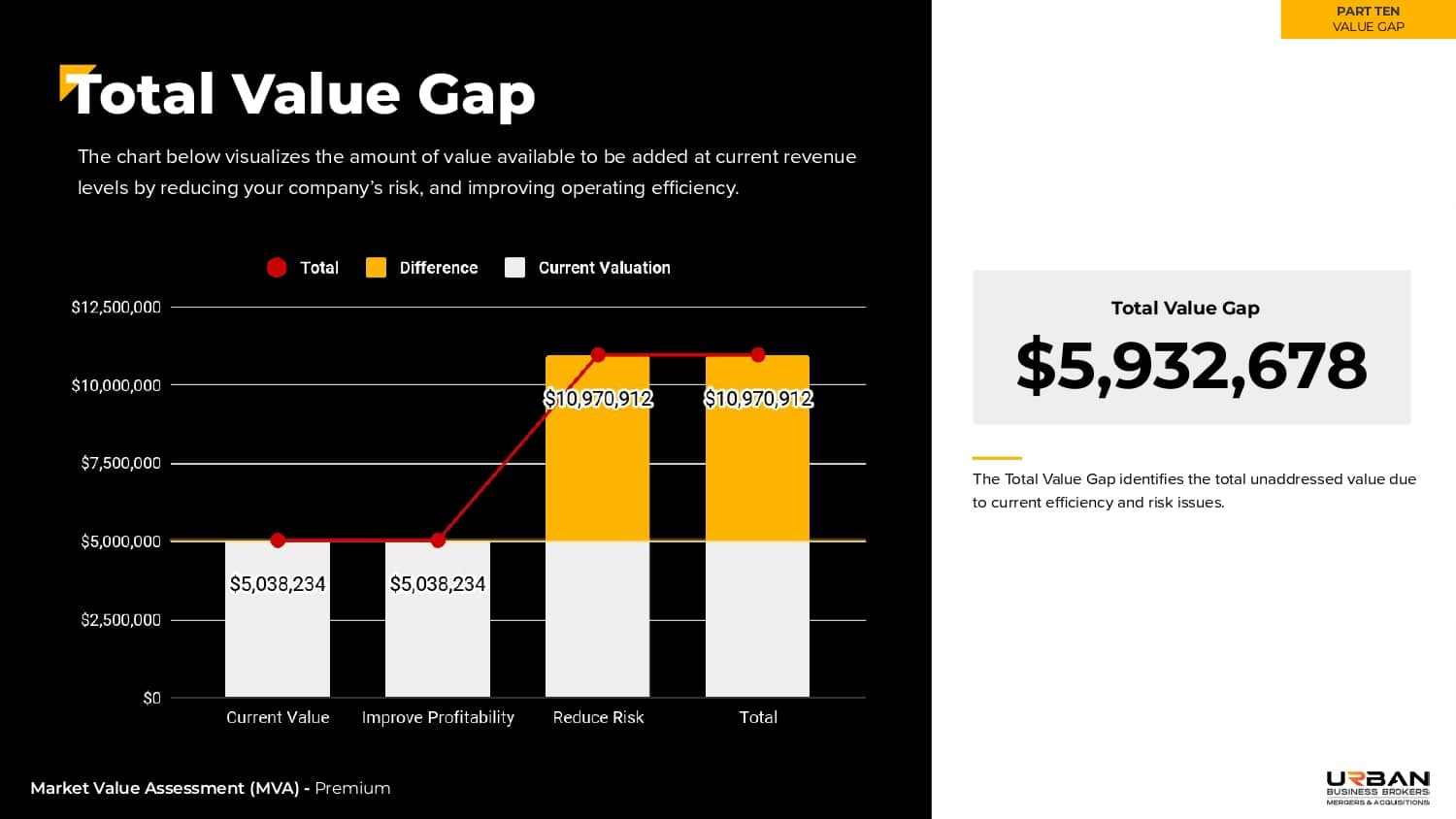

Using the findings in Part 9, this section identifies how much money will be left on the table at the time of sale as a result of certain inefficiencies.

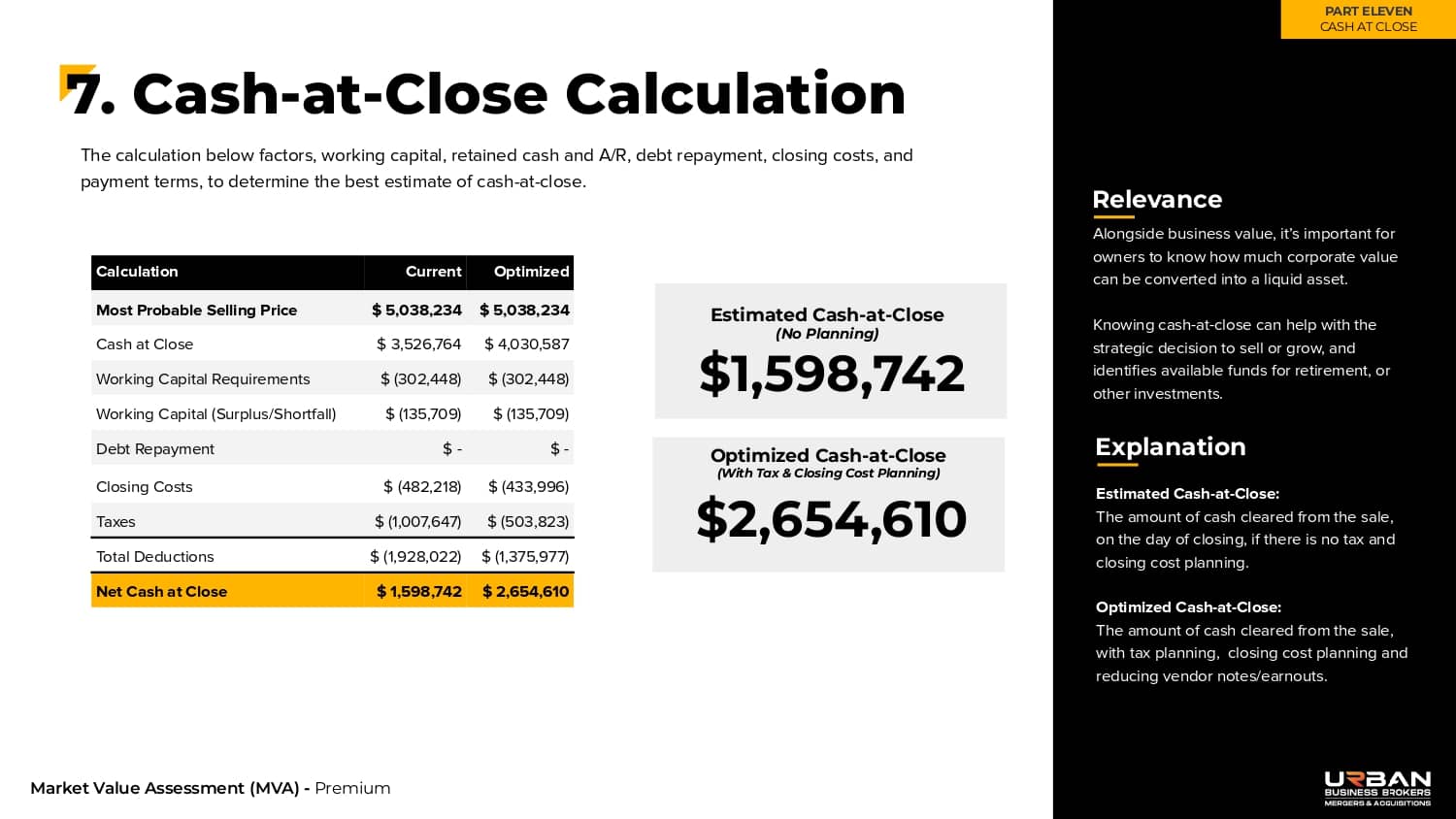

This section identifies how much cash shareholders will walk away with upon closing, after all transaction costs.

Schedule your free valuation with us today.

We run a free valuation with you to identify market value. We also determine if a complete valuation assessment would be beneficial.

Our streamlined online form collects your detailed information in as little as 15 minutes.

Our Valuation team completes a a preliminary analysis.

Our M&A advisor reaches out for additional clarity and information, as required.

Our 185-page MVA report is finalized and delivered to you, in electronic of physical formats.

Our M&A advisor personally walks your shareholder group through the valuation on a 60-minute call.

@2021 Urban. All Rights Reserved